News & Market Impact

- FII Sell-Off: Foreign Institutional Investors (FIIs) turned heavy sellers, offloading over ₹10,000 crore – the largest single-day outflow since February 28, 2025. This is attributed to anticipated MSCI index rebalancing.

- Geopolitical Tensions: Crude oil prices spiked 2% to above $66/bbl following reports of a potential Israeli strike on Iranian nuclear facilities, contributing to global market volatility.

- US Dollar Index: Declined to a two-week low, dropping below the 99 mark – a positive cue for emerging markets like India.

- Block Deal: KPR Mills saw a ₹1,196 crore block deal, as promoters plan to sell up to 3.2% stake.

📈 Market Outlook Today

Markets are expected to open flat to mildly positive, supported by optimistic earnings and a positive start in Gift Nifty (up 28 points or 0.1%). However, broader sentiment remains cautious due to:

- Sharp FII outflows

- Geopolitical uncertainty

- Softness in global cues, especially from the US markets

Despite a 1% drop in Nifty yesterday due to profit booking, underlying sentiment is constructive. Positive monsoon forecasts and a series of strong corporate earnings are likely to offer support.

Strong Q1 Results Reported By:

Gland Pharma, Dixon Technologies, Fortis Healthcare, United Spirits, Aster DM, Torrent Pharma, Whirlpool, Zydus Lifesciences, Man Infraconstruction, Solar Industries, Hindalco

Results To Watch Today:

ONGC, PFC, Mankind Pharma, RVNL, Colgate Palmolive, Oil India, UNO Minda, Astral Ltd, National Aluminium, Ircon International, Trident, Va Tech Wabag

Actionable Buy Ideas: Coal India, DLF, PNB, Dixon Tech, BEL

💼 Sectoral Watch

- Realty: Positive sentiment post strong earnings from DLF

- Metals: Bullish outlook as China cuts prime lending rate by 10bps

- Defence: Rebound likely after recent 5-7% dip

- Cement: Government’s infra push may drive momentum

🌏 Global Market Overview

Asia: Mixed cues with Japan, South Korea, and Australia gaining; overall regional index up 0.4% amid Middle East tensions.

US: Ended a 6-day rally with 0.3% decline in Dow and Nasdaq due to profit-taking and fiscal concerns.

Europe: Markets rose for the 4th straight session; Renewables rally on project approval off New York coast. Major indices gained up to 0.7%.

Gold: Surged 2% to above $3300/oz on global economic worries and geopolitical risks.

Brent Crude: Spiked 2% on reports of potential Israeli military action in Iran.

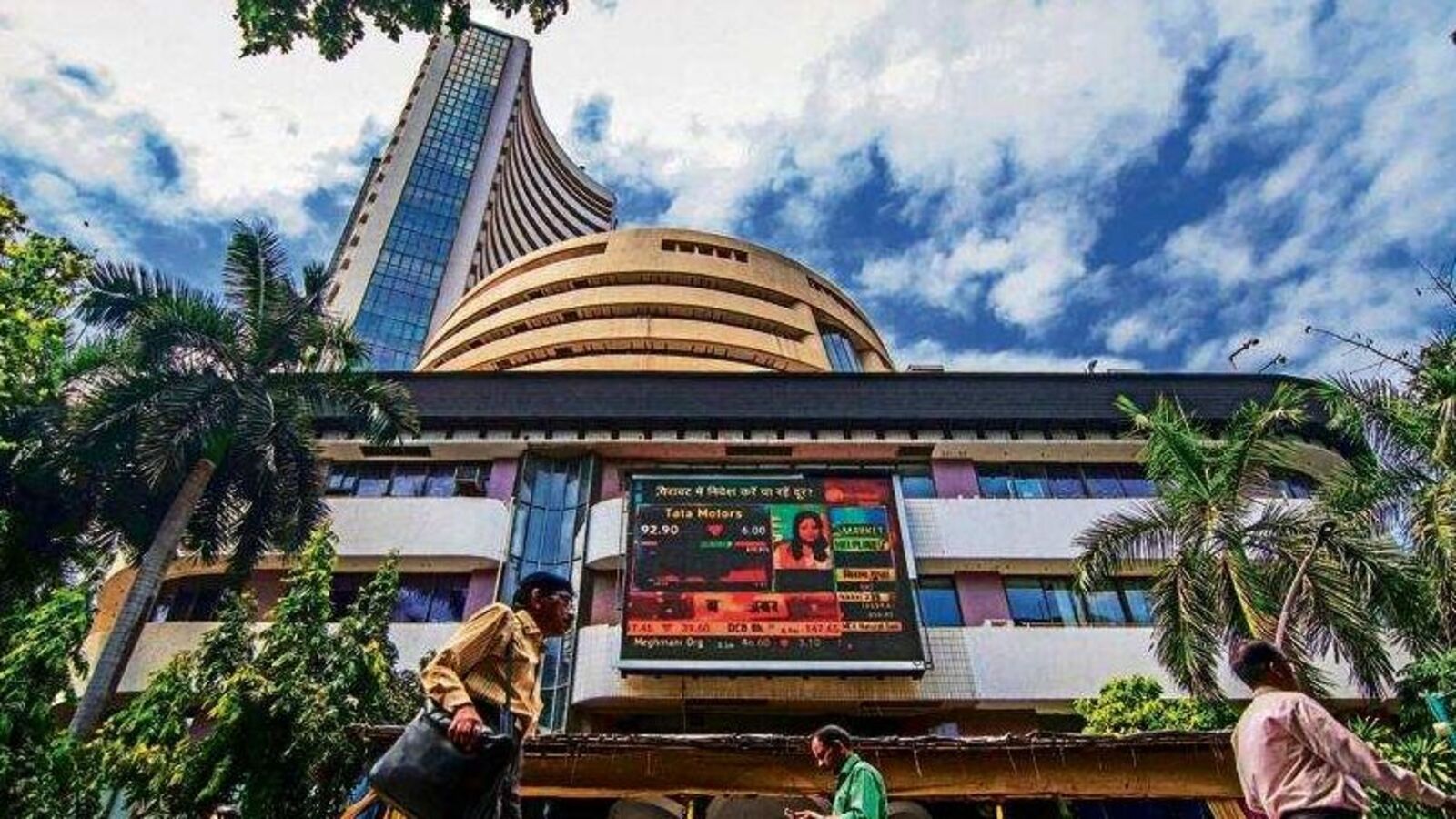

📊 Previous Day Recap

- Sensex: -872 pts (-1.1%) at 81,186

- Nifty: -261 pts (-1.05%) at 24,683

Indices dropped due to broad-based profit booking post a 4% rally last week. Weak global cues, MSCI fears, and lack of fresh triggers added pressure.

Advance/Decline ratio (Nifty 500): 1:4

- FIIs: Net sellers ₹10,016 crore

- DIIs: Net buyers ₹6,738 crore

🔧 Technical View

Nifty Levels:

- Support: 24,550–24,444

- Resistance: 24,850–25,000

Bearish candle on daily chart; below 24,850 may see further selling pressure.

Bank Nifty Levels:

- Support: 54,500–54,250

- Resistance: 55,000–55,555

Rangebound between 54,500–55,500; needs to sustain above 55,000 for momentum.

🏦 Brokerage Radar

- Torrent Pharma: Citi ₹4,000 | Jefferies ₹3,740

- Zydus Life: Citi ₹900 | JP Morgan ₹1,000

- Hindalco: Citi ₹800 (from ₹725), JP Morgan ₹720

- Dixon Tech: HSBC ₹20,000 | Jefferies ₹13,300

- DLF: Jefferies ₹1,000

- Infosys: Nomura ₹1,720

- Sun Pharma: Macquarie ₹2,135

- Amber Enterprises: CLSA ₹7,275

- Premier Energies: JP Morgan ₹1,013

- Restaurant Brands Asia: CLSA ₹117

📰 Corporate Highlights

- IPO Watch: Coal India subsidiaries BCCL & CMPDI to file IPO papers soon.

- Deals & Fundraising:

- Nazara acquires UK-based Curve Games

- IDFC First Bank to raise ₹7,500 crore

- PNB Housing Finance to raise ₹400 crore

- SBI to raise $3 billion via foreign bonds

- Growth & Expansion:

- Tata JLR to double India business in 3–4 years

- Waaree Energies acquires transformer firm for $34 million

- Airtel to offer Google One subscription to postpaid users

- Innovation & ESG:

- Lupin to use Honeywell Solstice Air Propellant

- Unicommerce partners with Tata 1mg

📅 Corporate Actions

- Colab Platforms Ltd: Stock split from ₹2 to ₹1

- Page Industries: Interim Dividend of ₹200/share

🌐 Global Data Watch

- US: MBA Mortgage Applications

- UK: CPI, RPI inflation data