India’s IPO market in May 2025 has taken a breather after a busy 2024, with activity slowing down amid global economic uncertainties and geopolitical tensions. While overall enthusiasm has tempered, several IPOs are still drawing strong investor interest, showing that sentiment remains selective rather than weak.

One of the standout performers has been Virtual Galaxy Infotech, whose IPO was oversubscribed more than 220 times. The strong buzz in the grey market indicated potential listing gains of over 50%, underscoring continued appetite for tech-driven firms. Another notable offering is Borana Weaves, a ₹145 crore IPO that opens on May 20. Early indicators suggest listing gains of around 27%, reflecting solid investor confidence in niche manufacturing businesses.

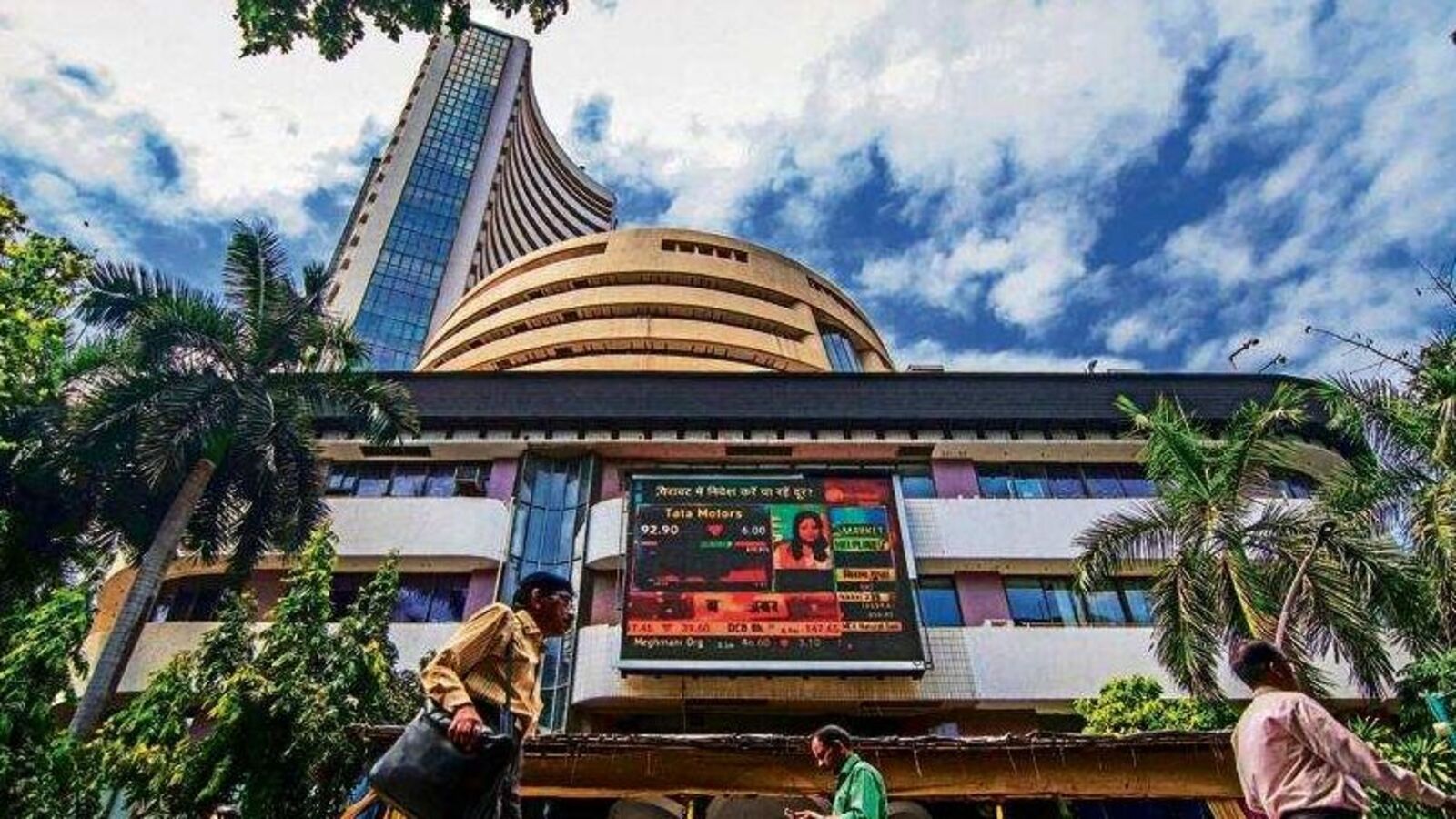

Looking ahead, big names are lining up. More Retail, backed by Amazon and Samara Capital, is preparing a ₹2,000 crore IPO that aims to fund its expansion and reduce debt. There’s also growing excitement around the National Stock Exchange of India (NSE), which has now crossed 1 lakh shareholders—a strong sign of market anticipation for its future listing.

Despite the temporary slowdown, the fundamentals of India’s IPO market remain healthy. The ongoing interest in high-quality offerings suggests that investors are being more selective, not withdrawn. As conditions stabilize, the IPO wave could pick up pace once again.